Xilinx and Mavenir today issued a joint press release announcing their collaboration on an OpenRAN massive MIMO (mMIMO) portfolio for 4G and 5G. Ahead of the public announcement 6GWorld™ spoke with key executives at both companies to find out more about what lies behind the announcement and what this may mean for the evolution of radio networks.

On the call were:

- John Baker, SVP Business Development, Mavenir

- Job Benson, VP & Head of Product Management, Mavenir, and

- Gilles Garcia, Senior Marketing Director & Wired & Wireless Group Business Lead, Xilinx

The OpenRAN Massive MIMO Announcement in a Nutshell

The press release describes the end-to-end integration of an end-to-end OpenRAN mMIMO system. “The next generation of massive MIMO capability will be ready for lab and field trials by Q4 2021 – so in about six months,” said Garcia.

There are two elements of the announcement that the companies are keen to highlight.

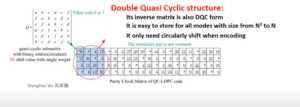

“This is an O-RAN Category-B radio. This is the first of its kind,” Baker explained. “I think other people have claimed to have mMIMO but this will be the first Category-B radio out there.” An explanation of the difference between Category A and B can be found here, but the key thing to note is that precoding is performed in the radio unit itself.

This is where Xilinx comes in.

“Xilinx is bringing integration of its newest silicon to meet the latest radio market requirements,” Garcia said, “Including, of course, the right balance in total cost of ownership between the performance, the power, and the cost, while still keeping some adaptability to either update to the latest 5G standards or update to new beamforming algorithms or new services that need to be delivered.”

Meanwhile, Benson described Mavenir’s role bringing in the other key element of the announcement – end-to-end integration.

“What we’re announcing is a full solution for massive MIMO. Not just the box, but the software that resides in the cloud and the ability to commercially deploy this, and that’s what we’ve been demonstrating,” he said.

There is software for managing beamforming, improved uplink in TDD systems, and more. “We’re talking about class-leading feature sets here, not just ‘my first massive MIMO,’” Benson commented. In addition to this, “In a live operator network, the operators need to keep the full operations and maintenance capability to manage and view the operations and performance metrics, see alarms, and things like that. All that functionality is there as part of our centralised management system.”

Layered on top of that is a systems integration capability: “Programme management, project management of initial deployments, all the way to being able to run the network, manage and maintain it and the optimisation features that go into it. We’re talking about a real end-to-end capability both on the software and services side.”

Why make this mMIMO announcement now?

“The timing of this announcement is driven by the clear growth in interest that we are seeing from operators in OpenRAN and all the regional requirements that we are seeing,” Garcia commented. “One of the key requirements on the OpenRAN market is the need for a high-end massive MIMO solution. That is something that every operator is looking for. To have spectral efficiency, high-end performance, energy efficiency on an OpenRAN platform.”

Baker added, “What you’re seeing now is the gestation period of products that originated about 18 months ago in the O-RAN specifications coming through. You’ve seen that with Evenstar Radio, who also use Xilinx technology; and in the programmes with Facebook and Telecom Infra Project etc. we’ve seen Xilinx integration there; and then developing that on to the mMIMO products.

“As with any hardware-silicon process it needs about 18 months’ lead time, so this is the first of many products you’ll start to see coming out with more specialised O-RAN silicon inside.”

Benson is keen to emphasise the operator role in this development.

“We haven’t been doing this in isolation or locked in a lab,” he said. “We’ve been engaged with six global CSPs; they’ve been impressed and provided feedback that this is a competitive platform. That’s where our confidence in launching this today comes from.”

“We learned a lot from their feedback and guidance,” Garcia agreed. “So our next generation, in labs and field trials by the end of the year, will be really matching their expectations.”

Deployment Scenarios for the mMIMO Portfolio

“The initial deployments are all expected to be in dense urban spaces,” Benson explained. “But there are going to be a lot more mMIMO deployments out there, especially as the expectation of users is for more and more performance. So we expect mMIMO to become fairly mainstream.”

Given the end-to-end nature of the offering, is this a solution that would work for private networks? Benson explained that the market is not quite ready yet: “Usually private networks operate in the unlicensed spectrum space… The unlicensed guys are going with something a bit more traditional, such as remote radio heads, but they’ll go to mMIMO eventually when they need that capacity. Their requirements are a little different from what the CSPs require, which is mass users, mass-market.”

However, “Certainly the software is down-scalable, and that will go to the enterprise space. You can support hundreds of users to millions of users on the same VNF structure. Again, if you want the density and ability to improve coverage then it can be used,” Baker said.“The challenge lies in covering all the frequency bands. It will happen at some point, but it will take time for the OpenRAN community to get all these radios in place with the different frequency bands for the global market. We are currently working with very specific bands – the C-band, the CBRS band, primarily the 5G-TDD frequency bands.”

Hotspots for OpenRAN mMIMO Adoption

“The C-Band is obviously a hot subject in the USA and obviously this translates into the 5G bands as you go around the world,” Baker commented.

Garcia pointed out that this is far from the only region where interest has been strong. “I think it was last October, Vodafone Europe made a public RFI announcing that Mavenir and Xilinx were included as part of the mMIMO shortlist. “So yes, we are seeing interest from Europe. India will be next, but in India the auction is still probably six months to a year out… There will probably still be a gap between India’s market readiness and spectrum allocation, but that is a key market and we see demand there.”

Energy Efficiency in Line With UN Sustainability Development Goals

“The challenge is all about the power transistors on the radios,” Baker commented, “So, given that power in the network is really all about these power devices, that’s where the real focus has got to be; and I think there’s a lot of work to be done getting gallium nitride [GaN] or other transistor technologies into a better shape.

“The nice thing about MIMO is you’re breaking it down into smaller ‘power lumps’ so you can start to look at other ways to use gallium nitride and things like that. There’s a black art of gallium nitride which needs a lot of investment to get your arms around.”

It’s not the only black art of power management, according to Garcia. “We are investing quite a lot to be able to use those GaN elements at their best efficiency and their lowest power, because sometimes people do not realise that you can save one or two watts into an ASIC or into our custom-adapted RF silicon, but if you spend those two watts […] by having a higher pre-distortion algorithm in the custom silicon we’re providing, we save 60 to 100 watts quite easily on the power amplifier. Between the spectrum efficiency and the power efficiency there’s a bit of a race too.”

Further Evolution

Garcia commented on the portfolio that Xilinx and Mavenir are working on. “We’ll probably focus more on the high-end 64t/64r and 32t/32r, because that’s where companies are seeing the gap in what the OpenRAN portfolio offers.

“After that… there are quite a lot of ecosystems that we are bringing together, so we’ll see.”

Benson shared a longer-term vision: “The whole shape of massive MIMO is expected to change. I mean, we can’t simply keep doubling up and doubling up.

“It’s going to get more distributed – smaller arrays getting more distributed across an area rather than just piling on more antennas. I think there will be certain applications where you’d have those super-arrays – few and far between, but you’ll have them, and they will be run with self-backhauling which would actually allow or enable these distributed architectures. That might be a much more energy-efficient, cost-effective way to deploy large capacity.”

“The industry’s looking at densification and obviously that’s an issue for 6G,” Baker noted. “You can either put up loads more cell sites or you can sectorise and sectorise. MIMO is effectively a way of sectorisation. I think the issue is about how you effectively roll this stuff out in volume.”