New wireless cellular networks promise growth for business and disruption for the traditional carrier model.

By Glen Allmendinger, President and Founder, Harbor Research, Inc.

A FRAGMENTED LANDSCAPE OF BROKEN PROMISES

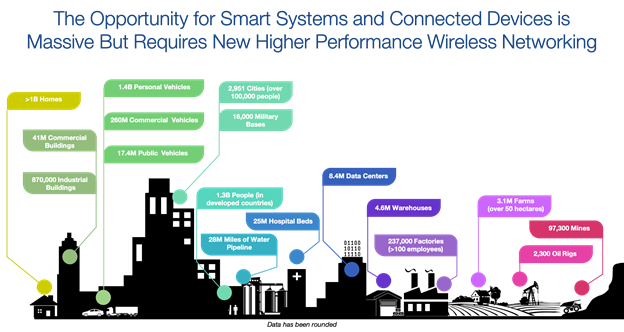

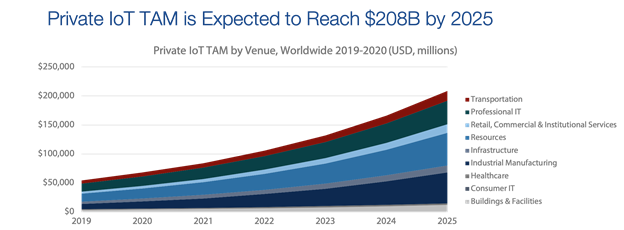

Wireless networking in industrial and mission-critical domains may not be news to readers of 6GWorld™, but the latest innovations in this realm are still a novelty to many people whose jobs and lives will soon be transformed by them. Indeed, the world of private LTE and 5G networking infrastructure represents a largely untapped growth opportunity, even though by 2025 it will have enabled a new age of pervasive connectivity and awareness that will foster entirely new modes of customer interaction and service delivery.

Source: Harbor Research, Inc

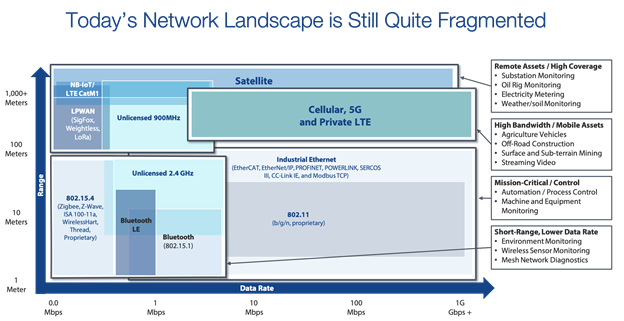

The “novel” reaction to this phenomenon isn’t hard to understand. Even though wireless networking has been around for decades and generally implies universal connectivity, you wouldn’t know that by looking at industrial and mission-critical domains like manufacturing, supply chain, transportation systems and energy.

Instead, what you see in those verticals is a fragmented landscape full of proprietary device networks, conservative users and buyers, and broken promises about the potential of wireless technologies. Few suppliers truly understand the requirements for managing multiple parallel installed networks in customer environments, where diverse stakeholders must manage complex settings like ports, mines, cities, transportation systems and more.

Historical constraints, including Wi-Fi’s incurable performance and security failings, combined with the high cost of commercial cellular service have limited wireless networking’s reach in the market. Wireless carriers have played it safe by defaulting to their consumer and enterprise subscription models, while OEMs who serve industrial and mission-critical arenas are promoting communications technologies like mesh networks that do not serve the range of applications needed by their customers.

Source: Harbor Research, Inc

ENTER 5G INFRASTRUCTURE AND PRIVATE LTE

The current state of industrial and mission-critical environments points to an inflection-point in networking technology evolution. The demand to connect more devices and leverage data-driven services is transforming the way OEMs, end users and technology suppliers interact. This will continually be hindered if wireless networks continue to isolate device groups in heterogeneous industrial environments.

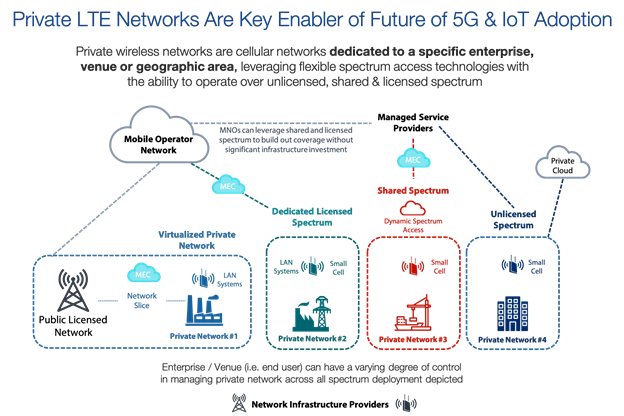

Amid all this noise and clutter, a new generation of wireless communications for challenging environments has emerged, running on small cells in unlicensed and shared spectrum. This new approach to connectivity—private LTE combined with 5G networking infrastructure—will finally enable the integration of diverse sensors, machines, people, vehicles and more across a wide range of applications and usage scenarios.

Source: Harbor Research, Inc

Private LTE/5G treats all user concerns—from reliability and service quality, to security and compliance—as challenges that can be addressed by a single, scalable wireless networking solution. Its key features will translate into direct benefits for the digital enterprise:

• Quality of service and predictable latency, configurable in software

• Seamless mobility to support service continuity between small cells and other networks

• The ability to roam between private and public networks

• Efficient co-existence with other spectrum users such as Wi-Fi

• Higher performance in terms of capacity and throughput, yielding superior payloads than Wi-Fi

• Fewer required nodes while supporting enhanced interference management capabilities, thereby reducing costs with a greater network footprint per access point

• Low cost of deployment and integration because spectrum license and operator contracts are not required

• The simplicity of deployment, analogous to Wi-Fi, in unlicensed spectrum allows support of any device without an operator or, in some cases, without a SIM card.

Source: Harbor Research, Inc

SUPPLIERS MUST BECOME “ECOSYSTEM ORCHESTRATORS”

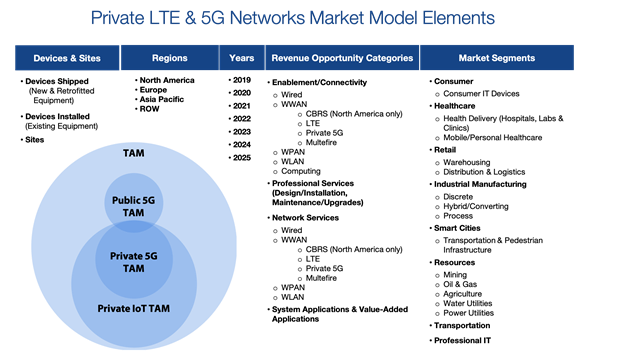

The advent of private LTE networks and the arrival of 5G network infrastructure has carriers, network operators and potential new entrants scrambling to understand how they will take advantage of this market. Brand-new capabilities like network slicing and network determinism are opening doors for machine learning and analytics players to optimize network performance for diverse applications.

But to realize the potential of private networks, OEMs and system suppliers must form new ecosystems where innovation will be driven by a collaborative community—from customers, from partners, and from their own people. To do this, they must become ecosystem orchestrators who will:

Target the Highest Value Customer Applications: Utilizing higher performance and more reliable private LTE networking technology to address diverse mission critical and industrial segments will open up many new applications where wireless use has been inhibited. Focusing on the right opportunities with the right partners will be a critical success factor.

Understand the Entire End-to-End Customer Experience: Companies often fail to develop networking solutions focused on the right capabilities and benefits because they don’t have a good understanding of what users and customers are trying to achieve and how they want to achieve it. Players can increase their chances of success by understanding the unique wireless networking requirements (i.e. performance, reliability, latency, managed services, etc.) in new applications such as safety-critical real time location systems.

Look for Non-Conflicting Business Models That Encourage Collaboration: Collaborative ecosystems are coalitions of self-motivated market participants that pursue a common goal, not mere subcontractors tied to a “command and control” scheme. Successful market development for new privately managed wireless networks will depend upon understanding and choosing new or modified business models. As control of these networks shifts to more neutral hosts, many new and novel managed services business models could and should emerge.

Build Open Collaboration / Align Partner Behaviors: Seemingly superior offerings can also fail because ecosystem partners have no incentive to participate. The customer is buying an experience with a desired result, and the ecosystem partners must work in concert to create a superior experience that provides tangible benefits to all participants. Successful ecosystems are usually composed of proactive participants, not simply a group of companies in and around a particular market space. Accordingly, a community’s design needs to allow participants to invest resources and reap rewards—indeed, to innovate openly with one another—while pursuing individual interests.

Act Early, Act Often: Assembling a collaborative ecosystem calls for a balance of timing and participants. Most collaborative opportunities will fail and re-form as learning grows. These communities do not necessarily have a finite window, but they need to be initiated early and gain momentum before a competitive ecosystem emerges in its place.

A “PERFECT STORM” OF NETWORK CONNECTIVITY

The opportunity for private LTE and 5G networks is vast, with an addressable market expected to exceed over 750 million device shipments by 2025. With this highly anticipated growth, industry players will move to capture and expand this value.

Source: Harbor Research, Inc

In IoT, private networking revenue opportunities exist across the entire technology stack, with much of the opportunity found in industrial manufacturing, supply chain, resource segments and energy.

The benefits of IP-based networking will soon become crystal clear, and this—combined with ongoing technical innovation—will accelerate the uptake of private networking adoption. For all these reasons, we believe that the world is on the cusp of a “perfect storm” of network connectivity.

To learn more about the Private LTE and 5G Networks market opportunity, visit https://harborresearch.com/private-lte-and-5g-networks/

#

Harbor Research is a growth strategy consulting and venture development firm that partners with leading manufacturers, service providers and technology developers to discover, design and develop smart systems and Internet of Things growth opportunities. Harbor

Research has predicted, tracked and driven the development and growth strategies of Smart

Systems and the Internet of Things since its inception in 1984.

Glen Allmendinger is the president and founder of Harbor Research and has been responsible for managing all of Harbor’s consulting and research activities since its inception. Glen has worked with a very broad range of leading technology innovators, product OEMs, and service providers assisting them with strategy and market development for new smart product, systems, and services opportunities. He has participated in pioneering research and consulting work in the Smart Buildings, Healthcare, Retail, Transportation, Energy and Industrial arenas helping clients to determine the scale and structure of emerging opportunities, competitive positioning, and design of new business models.

In 2005, Glen co-authored the pioneering article “Four Strategies for The Age Of Smart Services,” published in the Harvard Business Review. Glen has also authored thought leading articles for a wide range of publications including, The Economist and The Wall Street Journal, as well as being a frequent speaker in industry forums.