Last week, credit company Moody’s released their November outlook for the global telecoms industry’s financials in the coming 12 to 18 months. The top line message is that the telecoms sector will be facing flat margins, despite the fact that “Companies globally will accelerate cost cutting to offset energy and labour cost increases”.

Not surprisingly, Moody’s includes high inflation, high interest rates, and erosion of purchasing power as key risks globally based on the macro-economic climate. However, they also underline two big issues that are unique to the telecoms sector: Competition constraining pricing power and lack of ability to generate return on 5G investments.

This is even grimmer focussing on EMEA, where revenue growth is forecast at 0.5%, as opposed to the global average of 3%, “with few catalysts for improvement”.

Why mention this? Because, while the telecoms industry is huge and turns over vast amounts of money – the top 28 operator groups between them have annual revenues of over $1.2 trillion – the financial environment will inform their spending decisions and not only their desire but their ability to invest in advanced 5G services and beyond.

Enterprise Catalysts

Ironically, in some ways this may be a good time to spend on some of the fundamentals that will drive business transformation – and therefore investor interest and share prices – in the longer term.

The TM Forum released this blog post earlier in the year which addresses the impact that digital transformation programmes have had on share prices. Strikingly, there are very few cases outlined where digital transformation is about anything beyond making cost efficiencies.

When new technology capabilities are being developed constantly, why are operators not investing in a transformation to build significant new revenue streams? This, like restructuring for cost savings, would demand new operational structures, sales mechanisms, and brand positioning. However, it would at least break the industry out of a position “with few catalysts for improvement”.

In this research note, financial analysts at Morgan Stanley emphasise the upsides to 5G as a potential driver of new sales. They do so over a very long timeline, however – out to 2030.

The report’s analysts note that “the game-changing network could generate incremental annual revenue of $156 billion from seven 5G use cases over the next decade”. These are built primarily around business use cases – manufacturing automation, autonomous vehicles, smart cities, surveillance and healthcare, for example.

This, while encouraging, runs counter to analysis by Omdia’s Ronan de Renesse published ahead of last month’s Network X event. Though de Renesse also forecast revenue growth, he commented in an interview with 6GWorld that “enterprise is not the reason for growth in revenues in the next five years. I have yet to see evidence of use cases for growth.”

There is a certain irony here, as all the way back in 2017 enterprise use cases were front and centre in 5G-PPP’s 5G architectural white paper.

“In the course of identifying the requirements for the 5G network infrastructure a large number of use cases have been described and analysed through the interaction with the community of the industry verticals a number of additional use cases have been defined,” it reads.

Enterprise 5G, then, was intended to be a compelling proposition that would encourage enterprises to set up indoor and campus networks at their own expense. However, according to Omdia, the impact on the industry will be negligible ten years later on.

To put that in context, Netflix in 2002 had revenues of $0.15bn. Ten years after that the number was $3.6bn and a further ten years on, their revenue was $31.5bn. This, despite a market with massive competition, huge investment demands (into content) and a customer base not significantly tied in.

Netflix is not alone either; many other digital services have been able to pursue ambitious growth thanks to investment in effective marketing, customer support and service management alongside the essential technology.

There are a good many articles and opinions about why telecoms’ projected enterprise revenue hasn’t appeared, and it isn’t the objective of this article to go into that. However, a recent conversation with NTT’s Sharad Sharma, VP and head of B2B Business in the UK, underlined that whatever the technical capabilities of network operators are, in practice the sales process for enterprise has always been about devices and data.

In order to sell the benefits of 5G to underpin digital transformation, experts in the marketing and sales teams, and the operational processes backing them up, have to be put in place and often are not yet there within the telecoms operators. “How do you just train somebody to sell digital transformation?” Sharma asked. “It’s not possible. But that’s the benefit of 5G really – it’s not a service like SMS.”

Other people will put it down to the challenge of developing services for specific industries, finding ways to make the flexibility of 5G easy to deploy, or many other equally valid reasons.

What they tend to boil down to, though, is that while use cases were developed aplenty in the technology fora, there was not the same engagement and preparation from other parts of the telecoms industry to turn those use cases into viable services ready to lunch.

New Blood, New Approaches

While that may seem like doom and gloom, oddly this may be an excellent moment for operators to adapt.

In the last few years, grumbles about the shortage of skilled people with IT and cloud-native backgrounds have been common in the telecoms industry. How can staid old telcos compete against the excitement of the app ecosystem, internet, and cloud players for human resources that are in short supply globally?

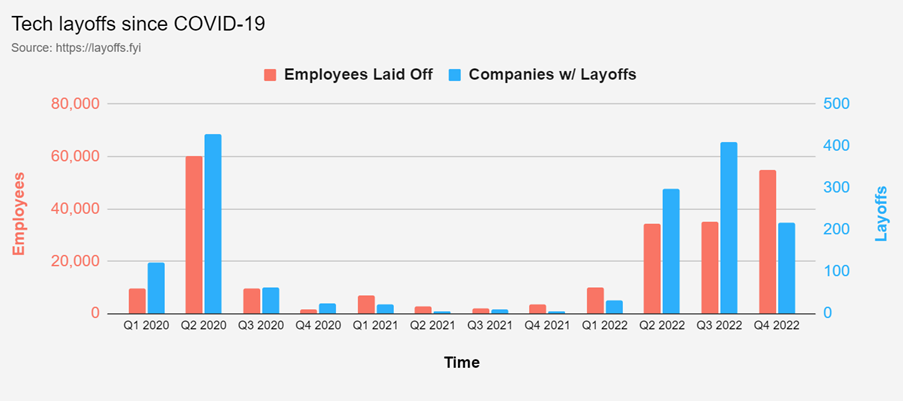

In fact, that perception of steadiness might be a selling point at the moment. 2022 has not been easy in the tech industry, with more layoffs than at the height of the COVID lockdowns.

According to data gathered by Layoffs.fyi, 2022 has seen over 134,000 technology jobs being lost globally. This includes US giants like Amazon, Meta and Twitter, of course, but has applied globally to the likes of Tencent in China, Dance in Germany, Deliveroo in Australia and Hopin in the UK.

As a result, now might be an advantageous time for telcos to recruit, taking advantage of the fact that talent is more readily available now than previously – especially considering the different mindsets of not just engineers but executives from IT and web backgrounds.

People who are accustomed to chasing growth as a key metric, and who are therefore practiced in generating new revenue rather than cost reduction, may be vital for enabling telecoms players’ own digital transformations not just technically but organisationally.

The 5G ideation and creation process produced a variety of use cases for the new generation. Hopefully in 6G we’ll see business cases and services being developed in parallel with the technology itself, so that we don’t need to wait a further decade for the promise to be realised.