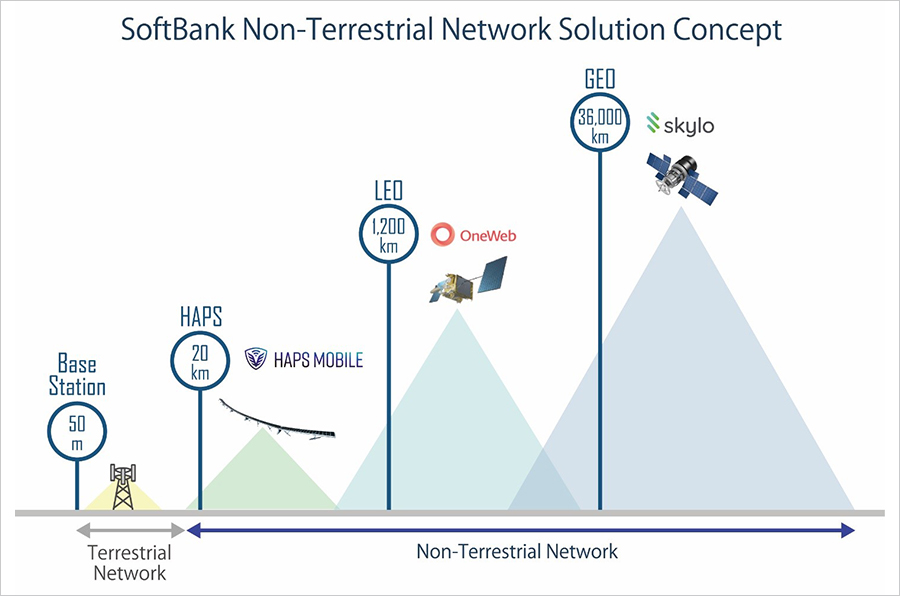

Sometimes a bird’s eye view isn’t enough. You need to look higher up, which is what SoftBank has done, adding Low-Earth Orbit (LEO) and Geosynchronous Earth Orbiting (GEO) satellites above its in-development Sunglider High-Altitude Platform Station (HAPS) to round out its Non-Terrestrial Network (NTN) solutions line-up.

LEOs & GEOs & HAPS, Oh My!

HAPS are typically situated 20 km from the ground in the stratosphere. LEO and GEO satellites are significantly higher up, with SoftBank describing them as being 1,200 and 36,000 km above the ground in a recent announcement that the firm would start promoting NTN solutions. SoftBank has since announced it seeks to deploy those solutions to help provide affordable connectivity to underserved African regions in collaboration with the Smart Africa Secretariat alliance (of which it is a member), for one example.

Talking to 6GWorldTM, SoftBank Vice President Hidebumi Kitahara discussed the individual solutions. The Head of the Global Business Strategy Division within SoftBank’s Technology Unit, Kitahara said the deployment timetable for the solutions to complement one another in real life is closer than one might imagine, with partner Skylo’s GEO satellite NarrowBand IoT (NB-IoT) services having already launched. Kitahara said partner OneWeb, in which SoftBank invested significantly at the start of 2021, will soon follow with its LEO satellite-communications services.

“OneWeb – we will launch service in a limited area from end of this year, global end of next year. HAPS – it’s going to take a longer time. The pre-commercial target is 2026 and global commercial is 2027,” he said.

6GWorld had previously talked to Ryuji Wakikawa, VP of SoftBank’s Advanced Technology division. He discussed subsidiary HAPSMobile’s contribution in the form of the Sunglider. He argued regulations are the biggest obstacles to the development of HAPS. He said the next International Telecommunication Union (ITU) standardisation meeting to get approval for the Sunglider’s use of spectrum in the stratosphere is in a few years. In this latest interview, Kitahara maintained the firm is where they expected to be at this point.

“For the HAPS, we have been working for the last three and a half years. We have done the flight test five times last year, going to the stratosphere for five hours,” said Kitahara. “In terms of developments, we are on track and there is good progress, but we’ve got lots of feedback by doing the test. So, there are a couple points we can improve… We are on track, but there are a couple challenges, but we do believe we can achieve the ultimate goal in the next five to six years.”

OneWeb Compared to Starlink

Kitahara said it’s a similar situation with regard to OneWeb requiring ITU authorisation. In that context, he suggested OneWeb would have an advantage over projected LEO competitor SpaceX’s Starlink.

“We have a top priority in terms of the spectrum so that OneWeb can provide a service anywhere, but [it’s] SpaceX’s second or third priority. They have to get rid of the interference, which means service availability to the end users is going to be much lower, because, when they overlap the beam with OneWeb, they have to stop,” he said.

Furthermore, due to the larger beam of OneWeb satellites, Kitahara also suggested gateway ground stations would be able to provide connectivity at sea, whereas SpaceX would find difficulties doing the same. He cited the maritime sector as one of many analogue industries SoftBank hopes to digitalise through its NTN solutions, among other use cases on the ground.

“Mobile carriers have to deploy base stations for those areas that don’t have optical fibre. OneWeb can help in support. It can be a backhaul to the base stations in super rural areas. They need to have high speed. They need to share the connectivity with all people. That’s the use case of OneWeb,” he said.

Secret Recipe to SoftBank Non-Terrestrial Networks

While the speed of Skylo’s NB-IoT services is slower than OneWeb’s, it suits devices such as temperature/ humidity sensors just fine, according to Kitahara. The projected price point, including of the accompanying hardware on the ground, is low as a result.

“Those sensors don’t need to have speed. Narrowband IoT is going to be enough, so maybe $1-2 per month in terms of the tariff price,” he said. “The secret recipe of Skylo is software on the ground. The pipe itself is the satellite [through partnerships with Thuraya and Inmarsat], but we put up kind of a gateway on the ground just behind the gateway to the satellite that supports the 3GPP-based core… Even if the downpipe is the satellite, [the hardware and software] can support the NB-IoT protocol.”

In contrast, taking advantage of the connectivity through the Sunglider wouldn’t require a device, with the target use case being more so people than individual sectors. The Sunglider would hypothetically complement the other NTN solutions in the ecosystem – potentially even Unmanned Aerial Vehicles (UAVs) in the future. To illustrate, in a previous interview with 6GWorld, the University of Padova’s Marco Giordani said drones can provide coverage themselves, assuming appropriate advancements are made, for example to ensure battery life becomes less of an issue.

“Even within the NTN solutions that we have, OneWeb [services] could be backhauled with the HAPS. We can put the OneWeb device on the aircraft so that you don’t have to have a ground gateway,” Kitahara said. “Obviously, for those autonomous UAVs, drones, those types of things, they need to have connectivity. In that case, I think HAPS will be very helpful, because […] you just need to have an LTE chipset or 5G chipset, which is very cheap and very common.”

Feature image courtesy of sdecoret (via Shutterstock).